Systematic Crypto Hedge Fund

Strategical Long/ Short Investments Management in a basket of crypto currencies

Investment Philosophy

Cryptocurrencies exhibit notable levels of volatility, exemplified by an average annualized Bitcoin volatility of 80%. This presents an opportunity for active investment managers, such as CTAs, who utilize systematic long/short strategies to potentially achieve superior performance by capturing both bullish and bearish market trends. In addition, investing in a basket of partially correlated cryptocurrencies is expected to achieve better performance compared to exposure only to Bitcoin thanks to portfolio diversification.

Disclaimer: these investment products involve substantial risks of loss.

Program Highlights

Investment Objective - Capital appreciation and alpha generation in crypto

Investment decisions - Based on backtested strategies

Investment horizon - Short to Medium

Target volatility - 120%

Leverage - Variable

\Financial instruments - Basket of top 500 cryptocurrencies by traded volume

Asset classes - Cryptocurrencies

Quant Global Macro

Deploying capital globally with a fully backtested system

Major Beneficiaries

Potential clients for our Quant Global Macro program encompass high net worth individuals (HNWIs), family offices, and institutional investors. HNWIs, in particular, often lack the time and resources for financial research and continuous investment monitoring, making it preferable for them to entrust capital management to investment professionals. Family offices may opt to invest in the strategy for portfolio diversification, aiming to leverage an investment product with performance uncorrelated to their existing assets. Institutional investors can consider allocating to a quantitative global macro investment product using a core-satellite investment strategy, adhering to predefined criteria established by their investment committee.

Program Highlights

Investment Objective - Capital appreciation and alpha generation in crypto

Investment decisions - Based on backtested strategies

Investment horizon - Short to Medium

Target volatility - 80%

Leverage - Variable

Financial instruments - Global Public Futures and forwards

Asset classes

Fixed Income

Currency

Commodity

Volatility

Equity

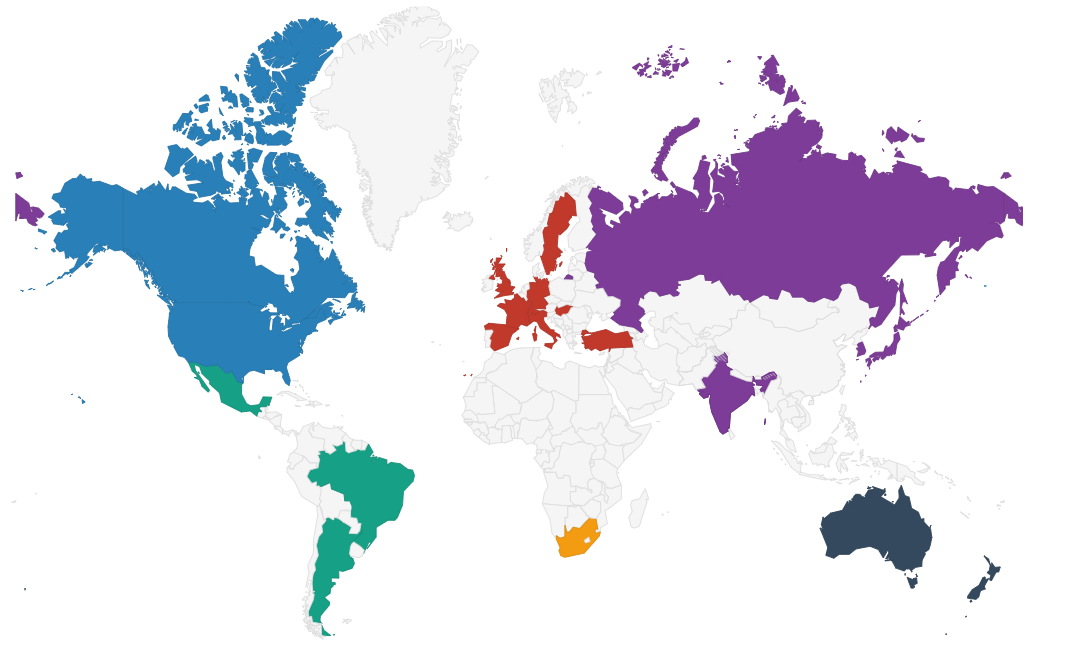

Geographic regions - World

Investments Strategy

Advanced Portfolio Diversification

The program deploys capital in a globally diversified investment portfolio covering all asset classes, including Equity, Fixed Income, Foreign Exchange, Agriculture, Energy, Metal Commodities, and Volatility.

Objective

The strategy is designed to provide uncorrelated and superior risk-adjusted returns relative to a 60/40 portfolio by utilizing portfolio diversification and tactical asset allocation techniques.

Disclaimer: commodity trading involves a substantial risk of loss.

Investment Horizon

The strategy focuses on capturing alpha sources found within long-term and medium-term investment signals that stretch across several months or even a few years. By doing so, the strategy minimizes transaction costs through less frequent rebalancing, in contrast to short-term investment approaches.

Investment Risk

The strategy aims to maintain a consistent level of portfolio volatility by periodically adjusting the leverage level. This element is designed to uphold a stable risk level in the investment portfolio regardless of market conditions.

Asset Classes

Fixed Income

The investment strategy allocates capital in the fixed income sector through bond investments across various maturities along the yield curve, encompassing short and long-term interest rates across diverse global markets. Geographic regions encompass North America, Europe, Japan, alongside other nations in Asia, Africa, and Latin America.

Equity

The program trades in equity instruments across various global regions. It invests in developed markets such as North America, Europe, Japan, and Australia, while also venturing into developing and emerging markets in Africa and Asia, including China, Hong Kong, Singapore, Taiwan, Indonesia, and South Africa.

Currency

The program engages in trading various global currencies such as the US Dollar, Euro, British Pound, Japanese Yen, Canadian Dollar, Swiss Franc, Australian Dollar, and New Zealand Dollar. It covers Forex pairs from both G10 and emerging markets to capitalize on a wide range of trading opportunities.

Commodity

The investment strategy trades commodities available on multiple exchanges over the world and from different sectors, including Agriculture, Energy, Industrial Metals, and Precious Metals. Examples of products traded include Crude Oil, Natural Gas, Heating Oil, Corn, Soybean, Wheat, Sugar, Nickel, Iron Ore, Gold, Silver, Copper, Platinum, and Palladium.

Geographic Regions

The investment strategy involves trading financial instruments across various global exchanges and asset classes. To construct a well-diversified global investment portfolio, the program allocates capital to developed and emerging markets worldwide. Markets traded include North America, Europe, Japan, Asia excluding Japan, Latin America, and South Africa.